A Righteous Deception

“Appearing at the UK’s Global Investment Summit, the PM was full of his usual hyperbole.

Instead of ‘thou shalt not kill’ and ‘thou shalt not steal’, Mr. Johnson’s own ten commandments – his self-described ‘dekalog’ – includes ‘driving the growth of low carbon hydrogen’ and ‘investing in carbon capture, usage, and storage.’

He used the speech to announce a new £400million partnership with Microsoft founder Bill Gates, aimed at supporting green power projects in the UK.” Tom Williams - Metro

#WTFhappennedIn2017

As we know that Cop26 is taking place in Glasgow, Scotland. I do not watch any news so I have stayed away from it and the clips I have seen are pretty much in line with what I have been messaging to the people and through certain channels. The signal is picking up and more people are paying attention. This is a good thing and it needs to continue.

I want to go back to something that was put together back in 2017 by a group I can not identify as of yet but will be able to as I move forward. I will be pulling some content from this report and speaking to it as much as possible.

Chemical Mergers

I have been keeping an eye on the Fertilizer narrative that is being spread around the media and certain financial channels plus in a lot of the agricultural platforms.

As we know that there is now a “Supply Chain Shortage” happening and it is about to get worse, especially food, certain good, and services. One aspect of this shortage that very few people are talking about is fertilizer.

Soil fertility is of central importance to farmers. They fertilize their fields to replenish the nutrients removed through the harvest. The three main nutrients, nitrogen, phosphorus, and potassium, are found in manure, chicken droppings, crop residues, and other materials of animal or vegetable origin. Mineral fertilizers also contain them, but their sources are different: phosphorus and potassium are mined from rock. Synthetic nitrogen is produced through a chemical process.

The invention of mineral fertilizers made possible the industrialization of agriculture first in Europe and North America, then in developing countries. The Green Revolution introduced Western agricultural practices to other regions. A billion-dollar fertilizer business has emerged. The industry proudly points to rising yields but ignores the negative impacts on soils, climate, and environment.

Corporations are trying to turn the international debate surrounding “climate-smart agriculture” (CSA) to their advantage. The Food and Agriculture Organization of the United Nations (FAO) introduced this concept in 2010. Its idea was to link agriculture, food security, and climate protection.

Selected practices adapted to local climate, and soil conditions were supposed to make smallholder farms more productive and boost humus formation. The idea is to adapt agriculture to climate change and promote carbon sequestration in soils, especially in developing countries. But the original idea changed quickly. In 2014, FAO, the World Bank, and several governments, as well as lobby groups and fertilizer corporations co-founded the Global Alliance for Climate-Smart Agriculture.

The aim of this alliance is to increase productivity by using fertilizers, pesticides, and improved seeds. It also wants to include carbon sequestration in soils in international emissions trading. However, measuring the carbon stock is difficult. And the prospect of making money with sequestration would give farmers the wrong incentives. It might promote unsustainable cultivation methods and land speculation that would threaten fundamental goods: food security, soil fertility, and biological diversity.

The production of artificial fertilizers is extremely energy-intensive, which means that their prices are tied to gas and oil prices. Synthetic nitrogen is produced mainly in North America, India, China, Russia, the Middle East, Australia, and Indonesia. Eighty percent of the potassium comes from Canada, Israel, Russia, Belarus, and Germany. Rock phosphate is extracted in opencast mines: more than 75 percent of the world’s reserves are located in Morocco and in the Moroccan-occupied Western Sahara. Since 1961, the consumption of artificial fertilizers has increased sixfold, and in 2013, world sales totaled US$ 175 billion. Manufacturers, especially phosphate and potash, dominate certain geographic markets or sectors and act as monopolists.

The biggest players are Agrium in Canada, Yara in Norway, and the Mosaic Company in the USA. They operate their own mines and factories; together they account for 21 percent of the global fertilizer market. For the period 2015–20, FAO expects artificial fertilizer deliveries to rise from 246 to 273 million tonnes. The latter includes 171 million tonnes of nitrogen fertilizer and about 50 million each of phosphate and potash. The industry expects uneven growth in this period. Africa is expected to have the strongest annual growth rate, at 3.6 percent, followed by Latin America, South Asia, and the successor states of the Soviet Union.

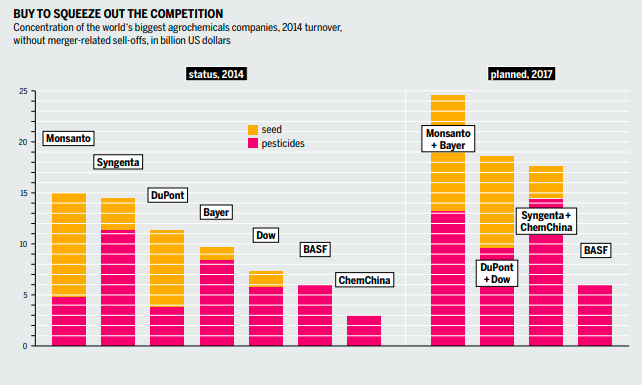

Seven companies currently dominate the global production of pesticides and seeds, a key sector in agriculture. The two US corporations DuPont and Dow Chemical have merged, ChemChina has bought the Swiss company Syngenta, and the German chemical giant Bayer has taken over the US company Monsanto. Three newly-formed conglomerates are now dominating more than 60 percent of the market for commercial seed and agricultural chemicals. They now manage the supply of almost all the genetically modified plants on this market. They also own the majority of patent applications for intellectual property rights for plants at the European Patent Office. The new Bayer-Monsanto is the world’s largest agricultural corporation, holding one-third of the global market for commercial seed and a quarter of the market for pesticides.

The management of DuPont-Dow split the new group into three listed companies, one of them an independently operating agrochemicals company.

ChemChina, a state-owned firm that is China’s biggest chemicals producer, has ownership in Syngenta. Along with Syngenta’s pesticide and seed production, ChemChina, already a producer of non-patented chemicals, has gained an enormous amount of knowledge on genetic engineering despite resistance by many Chinese about using this technology in farming, and doubts over whether the Chinese government will support the introduction of genetically modified plants.

Bayer financed the takeover of Monsanto with billions of loans. Bayer took on an enormous amount of debt with this acquisition. It has predicted the global turnover of seed and pesticides to increase from US$ 85 billion in 2015 to US$ 120 billion in 2025. For comparison: in 2015 Bayer and Monsanto had a turnover of US$ 25.5 billion and a profit of US$ 5 billion. Bayer AG, the world’s tenth-largest chemicals manufacturer, has expanded into seeds by acquiring other companies. It has joined the league of large multinational seed corporations, following in the footsteps of other chemicals companies.

Five of the world‘s seven largest seed producers come originally from the chemical industry: Monsanto, DuPont, Syngenta, Dow, and Bayer. No other company has swallowed more competitors in the seed sector than Monsanto.

This corporation began buying up seed producers around the world in the 1990s and now dominates a quarter of the world’s commercial seed market. It owns rights to most of the genetically modified plants, but also sells many conventional seeds, in particular vegetables.

Monsanto’s presence is difficult to detect because the companies it controls often keep their original name; Monsanto’s logo rarely appears on a seed package in Europe. The narrowing of the oligopoly from six or seven to three members has brought Bayer-Monsanto, DuPont-Dow, and ChemChina-Syngenta closer to their objective of dominating seed and pesticide markets and dictating products, prices, and quality standards.

All three groups have pursued the strategy of ousting other suppliers and eliminating competitors, if necessary through acquisitions. Thirty national antitrust authorities worldwide are still analyzing these mega-mergers with no success. The European Commission has ruled that DuPont must sell off some of its pesticides as well as its research and development branch. To squeeze past the regulators Bayer is forced to sell off its South African business in genetically modified cotton, as well as its Liberty Link crops and chemicals.

“The influence of transnational corporations can be difficult to detect. They often sell their products under the brand names of the companies they buy up.”

“How Bayer-Monsanto Became One of the Worst Corporate Deals.” WSJ

<STRONG><U>

Bayer-Monsanto Merger

“ChemChina Clinches Landmark $43 Billion Dollar Take Over of Syngenta.”

ChemChine - Syngenta Merger

“Dow - Dupont Complete Planned Merger.”

Dow - Dupont Merger

#WTFhappendin2017….is something a lot of people need to start focusing on. Most of the work and maneuvering all took place in 2017 for all three of these acquisitions/mergers.

Fertilizer Shortage

A shortage of nitrogen fertilizer due to soaring natural gas prices is threatening to reduce global crop yields next year, CF Industries.

European gas prices have jumped amid high demand, as economies recover from the pandemic and with below-average gas storage levels at the start of the winter heating season. Natural gas is a key input in the production of nitrogen-based fertilizers and higher costs have caused some producers to cut production.

Prices of nitrogen fertilizer, one of the most commonly used fertilizers to boost the production of corn, canola, and other crops, are at their highest levels in more than a decade.

Back on Oct 7th this report came out by Reuters:

(Reuters) - “Brazilian President Jair Bolsonaro said on Thursday his government planned to develop a project aimed at increasing the country's production of fertilizer and making it less reliant on imports.

Speaking during his weekly live broadcast on social media, Bolsonaro did not provide many details on the project but said it would be presented next month and improve the use of raw materials available in Brazil.

Earlier on Thursday, Bolsonaro told an event in Brasilia that he expected a shortage of fertilizers next year.

"I am warning you a year in advance, due to the energy crisis, China began producing less fertilizer and the price has already gone up. It will go up more and there will be a shortage," Bolsonaro said.

"For every five plates of food in the world, one comes from Brazil. We will have problems with supply (of fertilizers) next year," he added.

Brazil imported $8.71 billion of fertilizers in 2020, according to the United Nations COMTRADE database on international trade accounting. Of that, $664.41 million came from China.”

(Reporting by Maria Carolina Marcello and Ricardo Brito; Additional reporting by Anthony Boadle; Writing by Stephen Eisenhammer; Editing by Christopher Cushing)

<strong>

Copyright 2021 Thomson Reuters.

Food Supply Shortage

Grocery stores across the U.S. are experiencing food shortages and delays. Holiday staples such as evaporated milk, cooking oil, tofu, turkeys, bottled water, carbonated drinks, canned products, bread, liquor, and toilet paper are all in short supply.

Consumers can expect to see shortages and pay more for all of these items this holiday season. We continue to see supply chain disruptions throughout the food supply chain.

I am beginning to see some cracks in the COP26 conference currently taking place. There have been some countries that have pushed back and they are not getting their agendas signed off on by a majority. This is a good thing but it also could mean that there will be more government and corporate manipulation coming our way.

Something Prince Charles and PM Boris have quoted.

Prince Charles - Monday urged world leaders to take aggressive action to fight climate change, likening it to a "military-style" effort that requires major private investment.

Boris Johnson - A failure by world leaders to commit to tackling the climate emergency at the Cop26 summit in Glasgow could prompt “very difficult geopolitical events” including mass migration and global competition for food and water.

Parts of the US are now battling food shortages as worried Americans have emptied supermarket shelves amid the supply chain crisis threatening the nation’s economy and holiday shopping.

People are stockpiling everything from canned goods to boxed items and even making a run on milk when it’s available in grocery stores, Bloomberg reported.

The surge in demand comes as two of America’s major container ports in California face a massive pandemic-related backlog.

“People are hoarding,” Adnan Durrani, CEO and founder of Saffron Road, a producer of frozen and shelf-stable meals, told Bloomberg.

“What I think you’ll see over the next six months, all prices will go higher.”

Full NY Post Article

Cop 26 and The Carbon Credit Economy

A carbon credit is a tradable permit or certificate that provides the holder of the credit the right to emit one ton of carbon dioxide or an equivalent of another greenhouse gas – it’s essentially an offset for producers of such gases. The main goal for the creation of carbon credits is the reduction of emissions of carbon dioxide and other greenhouse gases from industrial activities to reduce the effects of global warming.

I am going to stop there for now. There is enough information to keep you guys busy moving forward.

This awareness is growing. I am calling it now, there will be a short-term food supply shortage over the holidays and this winter. After this food supply reset takes place a longer initiative will take place that will begin to engineer long-term nutritional famine.

COP26 is a pivotal point in our history, I am hoping that enough people are waking up and realizing what the true agenda is. Climate change is just a narrative to implement a #MonetaryReset which is also a #FoodSupplyReset that all lead to the #CarbonCreditEconomy. I will continue to break all of this down and move forward each week.

Pay attention and create your own algorithm for the next week on these keywords and phrases.

-Carbon Credit

-Cow

-Methane

-Fertilizer Shortage

-Energy Shortage

-Food Supply

The Beef Initiative and Texas Slim’s Vision

I went to Austin this week and I had an amazing visit, a scenic road trip, and a pivotal conversation, and moments of many reflections.

I will be putting out my #BeefInitiative and #FoodIntelligence article on Thursday. I am going to be writing about some very positive and exciting items that have transpired.

I will go into much more detail on Thursday but until then I would like you to share a rip that I did with Marty Bent on Friday. We sat in his back yard in his screened-in porch/office. What a fantastic conversation we had.

Join Marty as he sits down with Texas Slim, founder of the the Beef Initiative, to discuss:

As I was putting my report together, my new friend and podcast guru was able to produce my next episode for my new Texas Slim’s Vision Podcast.

I am happy to announce that the the Beef Initiative and the Oshi team of the Oshi App have now teamed up to bring Bitcoin Beef to the State of Texas.

Take a listen here and I will have much more to talk about on Thursday.

What do you get when you have 14 million cattle in the state of Texas and a population of 30 million people needing decentralized access to beef and animal protein. Quite possibly you get a Texas Beef Initiative that discusses leveraging the power of Bitcoin on something called the Lightning Network. Come join in and hear TxSlim and Michael - the founder of Oshi.tech discuss the next steps and the vision for each of their initiatives.

Texas Slim’s Vision Ep:02

A look at Texas History

I came across this podcast playlist a while back. Marty and I talked some Texas history. So for all, you wanna be Texans and already established Texans take a peek into the Texas Ranger and what it means to be a true Texan. In all honesty, you don’t have to be born here, you just need to know how to act and fight like a true Texan. Access podcast here.

I want to reflect on this past article that covers our quest for a High-Value Lifestyle. Moving forward the lifestyle articles are going to be quite fascinating and of extreme high-value. Catch up and get ready. The renaissance is about to happen! It is time to understand the:

Modern Texas Man

I would love to write more tonight but am going to save it until Thursday.

Stay positive and stay knowledgeable.

Before I forget you need to hear this mystery podcast. Start at 67:20 and then listen to the whole EP. - Don’t skip this!

“To ask permission is to lose the first step, you are the path with that first leap.”